The Dopamine Hit of the New Customer

Imagine you’re a founder who just celebrated a record-breaking month. Your advertising team successfully drove hundreds of new customers, and the feeling of momentum is addictive. This is the thrill of customer acquisition.

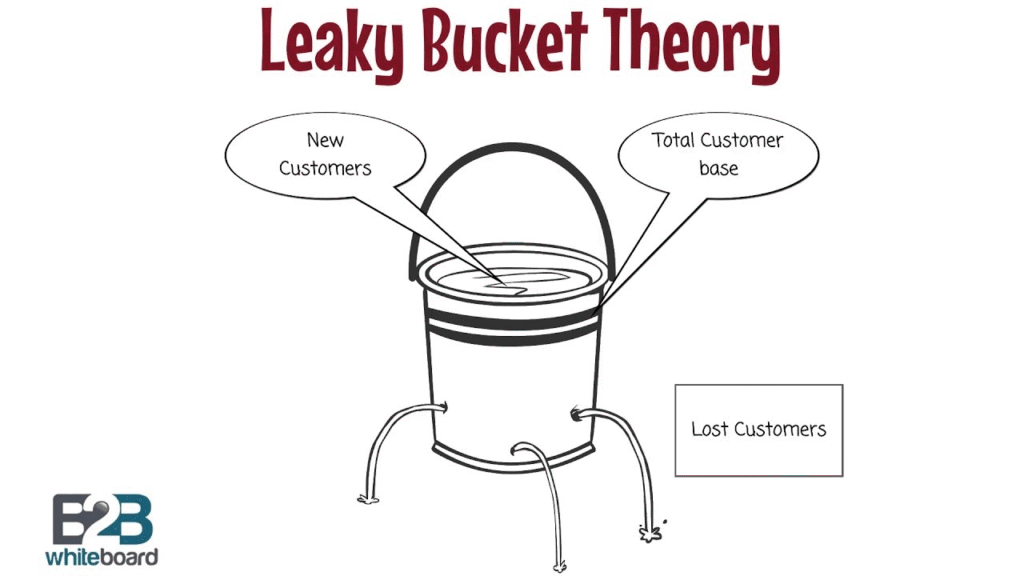

But here is the harsh reality: six months later, most of those customers have vanished. All the money, time, and budget poured into attracting them, your hefty customer acquisition cost (CAC) has been wasted by the silence that followed the sale. You are pouring money into a leaky bucket.

We call this fundamental strategic disconnect the Acquisition Illusion.

Defining the Core Problem

To solve this expensive problem, we must understand the difference between a transaction and a relationship:

- Customer Acquisition: The costly process of getting a potential customer to make a first purchase.

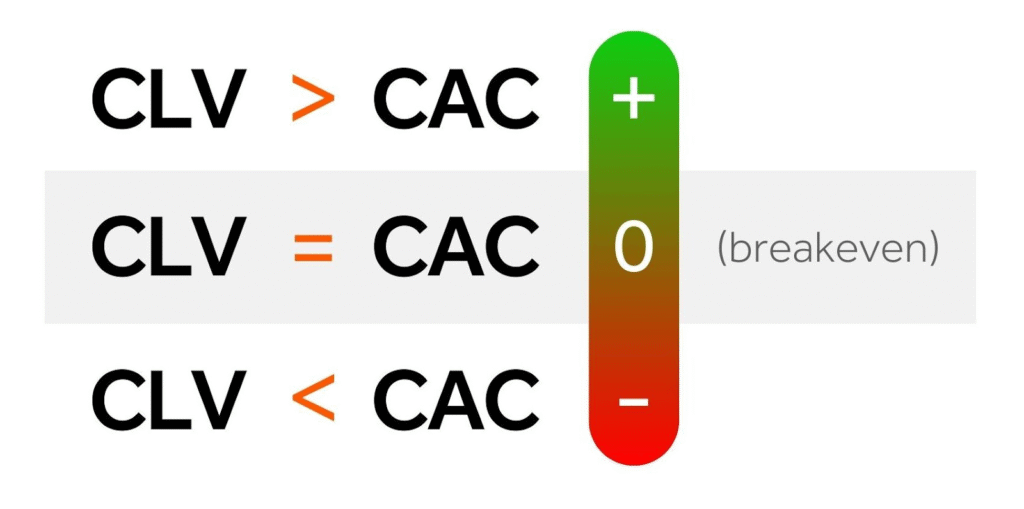

- Customer Lifetime Value (CLV): The total revenue a business can expect to earn from a customer over the entire course of the customer relationship.

The paradox is clear: why do businesses willingly pay a high CAC but then fail to invest anything in the customer follow-up that unlocks the true CLV?

The follow-up gap is the greatest threat to your profitability and total revenue. Acquiring a customer is a costly transaction; retaining them is a profitable relationship.

The Psychology of the Leaky Bucket

The failure to focus on retention is a common mistake rooted in short-term bias. Founders and marketers fall into this trap for three main reasons:

- The Addiction to Vanity Metrics: Marketers prioritize metrics like clicks and impressions because they are immediately measurable and generate a sense of accomplishment. Retention is slow, steady work that generates compounding CLV over time, making it less appealing for businesses focused on a short-term horizon.

- Misguided Budget Allocation: Leadership often views acquisition as the engine of growth and retention as expendable. This costly mistake means the acquisition strategies often neglect the existing customer, forcing the brand to constantly pay high acquisition costs just to replace the customers who churn out due to neglect.

- Ignoring the Ideal Customer: Aggressive acquisition efforts often chase volume over value, attracting customers who don’t fit the profile of a truly loyal customer. This drives up CAC without contributing meaningful total revenue to profitability. Smart brands prioritize finding valuable customers who will have a high CLV.

The 3 Costliest Mistakes in Customer Follow-Up

The post-purchase phase is the ultimate test of your brand. Failing here destroys customer loyalty and negates all your customer acquisition efforts.

Mistake #1: Treating Email Like a Receipt Folder

You paid a premium to acquire the customer and secure their email. This is your most valuable owned marketing channel.

The Problem/Cost: Most brands send the purchase confirmation and then go silent. The existing customer has completed their first customer journey, but the brand has abandoned the customer relationship. This immediate drop-off tells the customer they are only valuable for their money.

The Result: The customer forgets who you are and becomes a price shopper, actively looking at competitors.

Citable Statistic: A 5% increase in customer retention can increase profits by 25% to 95%. This disparity proves that customer retention is the key to sustainable profitability.

The Solution: Establish a post-purchase sequence and a Weekly Value-Driven Newsletter. This consistent customer interaction builds customer satisfaction and maintains brand awareness, turning one-time buyers into repeat customers.

Mistake #2: Prioritizing Immediate Clicks Over Long-Term Trust

This costly mistake involves optimizing every customer interaction for the next quick conversion rather than for long-term customer loyalty and trust.

The Problem/Cost: This transactional approach is most damaging during high-friction moments like the returns process. If a customer encounters a painful, expensive, or confusing returns portal, all the effort and budget spent on acquisition is instantly wasted. A clunky returns policy is a direct reputational hazard.

The Result: You generate negative customer feedback, destroy the customer relationship, and lose a repeat customer.

The Solution: Frictionless Experience is Retention. You must simplify the customer experience across the entire customer journey. This includes making returns as easy as the initial purchase. Companies that master this, like those leveraging platforms such as Redo to provide hassle-free returns and exchanges, turn a moment of frustration into an opportunity for deepened trust and guaranteed future purchases.

Mistake #3: Not Tracking the Full Customer Lifetime Value (CLV)

This is the ultimate financial mistake that prevents businesses from making an informed decision about resource allocation.

The Problem/Cost: Businesses focus their reporting solely on the first purchase revenue, ignoring the potential total revenue of the loyal customer. Without knowing what your ideal customer is worth over time, you cannot accurately set your pricing strategy or judge how much you can afford for acquisition versus retention. This structural error is a failure of profitability.

The Result: You continue to fund aggressive acquisition strategies that are financially unsustainable because you don’t see the value of the existing customer segments.

The Solution: Track CLV and Retention Rate with the same rigor you apply to CAC. Use customer data and customer insight to identify the most valuable customers and make retention investment a priority.

The Case for the Owned Channel: Building Long-Term Relationships

The core of overcoming the Acquisition Illusion is making the informed decision to shift focus and budget.

The Math: Retention’s Exponential Profitability

The core of the strategy is simple: retention is exponentially cheaper than acquisition. Your acquisition costs are high, immediate, and stop working when the budget runs out. Retention costs are low, compounding, and continue to generate revenue long after the initial investment.

An email list is the most important owned marketing channel a business possesses. It is a direct, reliable line of communication that builds customer loyalty that cannot be taken away by algorithm changes.

Proximity Breeds Preference: regular, valuable customer interaction builds genuine trust. When buyers are ready to make a new purchasing decision, they will default to the brand that has consistently stayed present and helpful. This protects your reputation and makes your initial customer acquisition efforts worthwhile.

Your Key Takeaways

The most successful brands are defined by the strength of their retention strategy, not the size of their acquisition budget. By reframing customer retention as Reputation Management, you move past the costly, short-term Acquisition Illusion.

Three Actionable Next Steps to Stop the Leak:

- Audit Your Post-Purchase Sequence and Friction Points: Review your entire post-sale customer journey. Crucially, review your returns process (the key loyalty test). Consider streamlined solutions like Redo to turn returns from a loss into a retention win.

- Make the Informed Decision to Invest in Content: Set a goal to send one valuable piece of communication per week to serve your existing customers.

- Reallocate Budget Based on CLV: Take 10–15% of your lowest-performing acquisition budget and redirect it into retention efforts. Track the resulting CLV increase. This is the key takeaway for maximizing total revenue and achieving long-term profitability.

The future of your business rests in the hands of the buyers you already have.

Ready to Close Your CLV Gap?

Book a free consultation with Green House today. We’ll audit your current customer follow-up strategy, identify your hidden CLV gaps, and build repeatable retention systems that turn first-time buyers into lifelong advocates.

Frequently Asked Questions (FAQ)

Q: Why is customer retention considered more profitable than acquisition?

A: It costs significantly less to sell to an existing customer than to acquire a prospective customer. Existing customer loyalty contributes to high customer lifetime value, and a higher retention rate exponentially increases profitability and total revenue.

Q: What is the “Follow-Up Gap”?

A: The Follow-Up Gap is the period of silence or neglect that occurs immediately after a customer makes their initial purchase. Marketers who fail to engage their new buyers after the sale are essentially negating all their customer acquisition efforts.

Q: How often should I communicate with existing customers?

A: For most SMBs, we recommend aiming for at least one piece of valuable, non-salesy content per week via your owned marketing channel. This builds brand awareness and improves the customer relationship.

Q: What is the fastest way to increase Customer Lifetime Value (CLV)?

A: The fastest way to increase CLV is by reducing churn through better customer retention strategies and an improved customer experience. This requires implementing a robust post-purchase sequence and reducing friction in high-stress areas like customer service and returns.

Q: What role does pricing strategy play in retention?

A: A sound pricing strategy must be built around a healthy customer lifetime value. If a business prices its products without accounting for the high customer acquisition cost needed to replace churning customers, it will never achieve sustainable profitability.

Q: How can a weekly email newsletter save me money on ads?

A: By maintaining an active customer relationship with your list, you drive up your repeat customer rate. This increased revenue from existing customer segments means you don’t have to rely as heavily on costly paid customer acquisition efforts to meet your total revenue targets.

Resources & Further Reading

For those ready to dive deeper into the strategies and statistics mentioned in this post:

- The Customer Retention/Profitability Statistic: The foundational research into the exponential profit increase resulting from customer retention is discussed in Zero Defections: Quality Comes to Services by Frederick F. Reichheld and W. Earl Sasser, Jr. (Harvard Business Review). Read Now

- Frictionless Returns (Redo): To explore how to turn the complex returns process into a customer retention and trust-building tool, visit Redo. Learn More